New Mexico Workamping Update: Final Edition

Disclaimer: We are in no way affiliated with or representing Jackson Hewitt. We are simply detailing our experience for those interested in our Workamping Job in Albuquerque, New Mexico.

April 15, 2019: Our fourth official workamping job has come to an end. Just like all our previous ones, it was a positive experience. Unlike our previous one, we didn’t work at a campground and we traded shorts and flip-flops for dress clothes. We have always enjoyed and appreciated reading about others’ experiences working on the road. So to those who have shared their stories with us - thank you! As a way to pay it forward, we hope this recap of our workamping experience in New Mexico will provide similar information for others. Remember that your job experience is what you make of it. Below you will find some information about the job and area as well as some numbers that detail our experience.

Employer: You’ve likely heard of this one — Jackson Hewitt. We worked for a franchise owner of Jackson Hewitt, who has locations in Texas, New Mexico and California. While we didn’t ever actually meet the owner, Matt, in person as he is stationed in Texas, we did have interactions with him via phone, email and chat. We were trained and had more frequent interactions with the general manager, Nancy as she frequently traveled between the locations during tax season. Each of the locations also had an area manager and that was who we worked most closely with during our job. As far as we know, Matt was the first and is still the only franchise owner using workampers for their seasonal tax business. Not being RVers themselves, they were fairly open to suggestions of how to make it work best for both parties.

Hours / Schedule: We accepted the position with Jackson Hewitt in August of 2018 and we were asked to complete an online training prior to arriving for on-site, in-person training starting in December. One of the biggest draws for us accepting this job was the timeframe. It worked right into our ideal plans as we had hoped to spend the holidays with family this year after not being able to do so the year prior. Thanksgiving was to be with the Gibbons Clan in Pennsylvania and Christmas celebrations were scheduled in Ohio with the Dutt Family. Being that our job in Texas wrapped up exactly one week prior to Thanksgiving, gave us a chance to hop on a jet plane and celebrate with our PA family, just as hoped before pointing the nose of The Big Tow’er and Charlie the RV west to Albuquerque.

When we applied for the job, they let us know that training would run December 10-21 and then resume after the New Year. That meant a trip to Ohio to see Ol’ Saint Nick over the Christmas holiday could happen. Not only did the start date work out, but with a mandatory tax deadline of April 15, so did the ending date, as we would be able to start our summer job outside of Philadelphia in early May. They say timing is everything and that was the case for this Workamping job.

The schedule was put out on a weekly basis and we were pretty much given the amount of hours that was laid it in our contract. Most weeks were just about 40 hours with the ramp up and ramp down of the season being a little less. We ended up both averaging 38 hours over the duration of about 15 weeks. As we have found with several of our workamping jobs, the schedule is not always put out in a timely manner, making it hard to plan things in advance for days off. The earliest shift started at 9 AM and latest closing shift finished at 7 PM, with hours being both during the week and on weekends, including Sundays. If working weekends, isn’t your thing, this may not be the job for you! We did get the same two, sometimes three days off per week together and almost every week they were two consecutive days.

Environment: We would consider the work environment to be a little more formal than several of our previous jobs and for obvious reasons. Would you want your taxes to be prepared by a workamper wearing an oil-stained t-shirt from working on fixing a golf cart and grassy green sneakers from cutting grass? Likely wouldn’t be your first pick. So, it started with the dress code of business casual. Not suit and tie of course, but not grass-stained sneakers either! Things were just more business-like, we had business cards with our names on them, desks to sit at and log-ins for computers. You know the fancy, corporate world things! While the standards were the same across the board, the work environment was slightly different depending on which office you were working in. As you have probably likely seen, Jackson Hewitt often has kiosks located inside of Walmart locations during the tax season. We only worked at a Walmart location a handful of times and I am sure you can imagine that environment differs from that of a permanent Jackson Hewitt office location. We did work in more than one office and some were more fast-paced than others due to more client traffic in and out. It was a much quieter environment and you would often work with the same co-workers and get used to their quirks and habits. Luckily, we had the chance to work with mostly positive and professional co-workers, but we were sometimes frustrated when dealing with others who didn’t seem to take the work quite as serious. I had read that the people of New Mexico often have the “land of mañana” attitude, meaning everything can wait until the next day. They don’t have a reputation for punctuality or productivity which are kind of the things that make our blood boil! The work environment wasn’t always as organized as I would have hoped, but that is a high bar in our books as we tend to like things very orderly and visually appealing! The offices could have all used a little bit of renovation to spruce them up. They were doing bits and pieces that did help and I believe had plans to do more. I suppose overall it probably didn’t affect business enough to justify cost, but would help the overall feel of the experience. I liked the idea of each office getting a small budget and leaving it to the employees that would be working their how to make the most of it as a sort of contest (with guidelines, of course)!

Considering that they had multiple offices across multiple states, they did do a good job of uniting the troops using things like weekly mandatory tax preparer calls and fun game which were run through the company chat page via Slack. Trivia games, Bingo and giveaways were done randomly and office decorating contests (taken very seriously by ex-teacher Betsy) were used to celebrate holidays even while working.

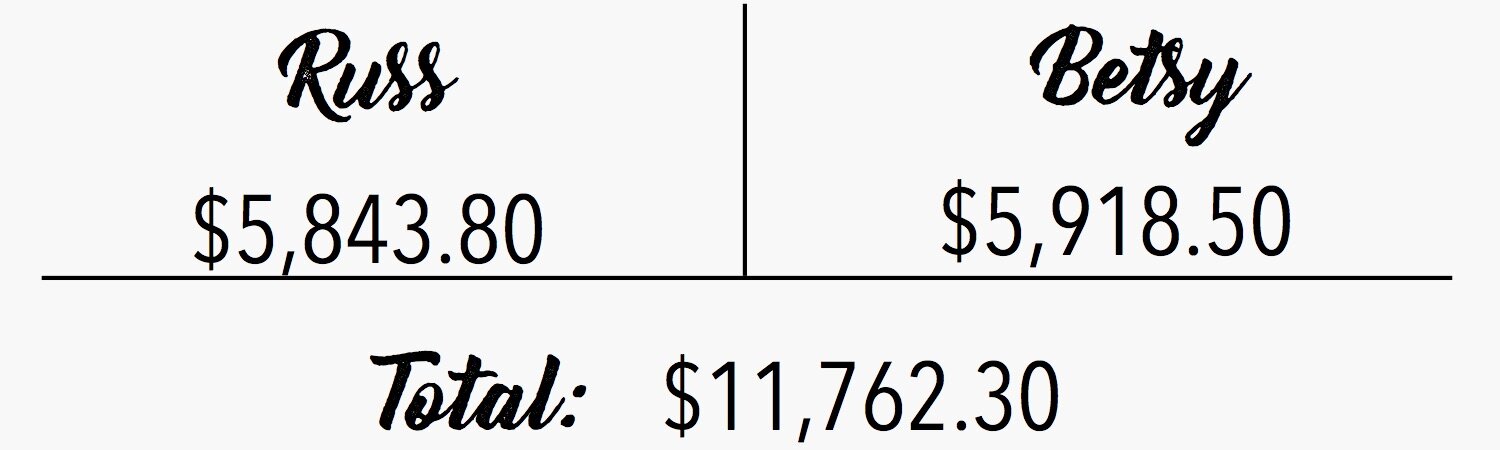

Compensation: So money isn’t everything, but everything needs money. So let’s get down to it. Being that we had the same schedule, our hours worked were very similar. On average, I worked an average of 29.5 hours a week, while Russ averaged 29 hours a week. Occasionally, we would be in the middle of completing someone’s return at closing time so one of us would clock out, while the other would finish up with the customer before clocking out. Most days were 8 hour days, but we did work some longer days during the busiest part of the season. We were paid $10.00/hour for all hours worked and did receive a very small bonus at the end of the season.

As you can see, we are not getting rich with our day jobs, but have found a sense of freedom in this lifestyle. One of the biggest known perks of Workamping jobs is a free campsite. Whether it equates to paying a mortgage, renting an apartment, staying in a hotel or parking our “home” Charlie at a campground, money is always involved in where you lay your head at night. So we consider it part of our compensation when a job includes a free place to park our home! This eliminates a big line item on our budget sheet which means earning less is okay. When less is going out, less can be coming in without as much worry. One downside to this was that when we were asked to move to another campground which had weekly rates, we had to oblige. Our monthly site rent was due at the Albuquerque KOA about a week into the month and our employer didn’t want to pay another month considering our jobs would be ending in about a week after that. While understandable, it was unexpected and a bit inconvenient.

While some workamping jobs include all utilities, this one required us to pay our own electric which we were told from the get go. The cost per kilowatt hour was more than we had paid in some states and less than others and in the end we paid $707.31 in electric charges over the duration of our stay.

Cable and WiFi was included with the monthly site rent, so that was another added “free” bonus. The cable was decent which saved us from needing to activate our Dish satellite which adds a bill of ~$80/month. As far as “campground wifi” goes, we had pretty decent luck with connecting. We do use a WiFi booster (affiliate link) which does help in some situations. So far our travels haven’t brought us a campground with what we would consider outstanding WiFi, but again we do have to remember it is a “free” bonus!

Job Duties: Our job duties were exactly in line with what our job titles were - Tax Preparers. So what did the job require? To prepare taxes. This is exactly what we did, but even though tax laws and forms are super serious, I would say the bulk of the job was to provide great customer service. We’ve said it in one of the previous workamping updates that when we first applied for the job, we thought it was simply for customer service - answering phones and scheduling appointments. However after chatting with the owner of the Jackson Hewitt franchise, he made it clear that it was more important to posess superior customer service skills and that he could teach us to do taxes and he was right. The bulk of preparing someone’s tax return is conducting an interview with the customer to gather all necessary information to complete the return correctly. With that being said, the job did of course still require us to understand tax codes and tax reform. This is where the online tax school came into play. We were originally told the course would take about 20 hours. However, at some point we surpassed the 60 hour mark. You do have to remember that it was unpaid training, so it wasn’t all that motivating to want to complete. We did successfully complete and PASS all the segments before reporting to the job. While we weren’t overly excited during the process and sometimes felt like the information wasn’t truly sinking in, it was amazing how much we had learned when we started doing practice tax returns. After all, one of our goals when we pick a workamping job is to find an opportunity to learn and try new things and that we did! To read more about what a day in the life of a Jackson Hewitt Workamping Tax Preparer looks like click here.

Location: We arrived to Albuquerque in mid-December just in time to enjoy some sunshine and warm weather, but before long things got cold, really cold. Bitter cold temperatures, sleet, snow and gusty winds were not what we were expecting in the desert Southwest. We kept seeing reports of “unseasonable cold” and hearing “it is never this cold here.” For a city who boasts about their sunny weather, we had been less than impressed. Then March came and we were awed by perfectly warm blue-sky days and cool nights filled with colorful sunsets. All was right in the world again! The cold weather did make for great views of the Sandia Mountains out the back window of Charlie the RV.

Enough about the weather, but that is a big decision when your house has wheels and your favorite shoes are are pair of Birkenstock sandals. But anyway! Albuquerque gets a bad rap and does have high rates of auto theft and crime. Poverty levels are high all across the state, leading to homelessness and poor education standards. We often dealt with coworkers and neighbors at the campground complaining of these things and we often would ask them, “What large city do you know of that doesn’t have these problems?” It isn’t often that you stay at a campground that is literally within walking distance of a Costco and within 9 miles of the city’s downtown area. It is what we would consider “Urban Camping” and while yes, things like crime exist there are also a lot of great things about the city. Albuquerque is recognized as one of the most culturally diverse cities in the country which was one of our favorite things about it. We were able to enjoy its ethnic architecture, artwork, cultural centers and cuisine as well as all the perks of having a mountain range nearby.

There certainly are perks to working at a campground as that eliminates any sort of commute, which was not the case with this job. We did have to drive between 10 - 40 minutes to different office locations. The office location we worked at most was just around 15 minutes which was amazing as we were commuting in the city right at rush hour and traffic didn’t seem to really exist. That was always a pleasant surprise, even though the locals complained about how bad traffic was. Guess they have never driven through downtown Atlanta or down the Schuylkill in Philadelphia! In contrast, when you live where you work, there is always the chance of getting calls or having to attend to a situation after hours. Whereas a workamping job not at a campground that requires a commute, likely once you are home are off the clock. Add in to that the need to always have a lunch packed and ready, instead of walking home to the RV for lunch at a campground job. There is advantages and disadvantages to being parked where you work and vice versa.

OUR EXPERIENCE IN NUMBERS:

The number one question people ask is “Would you do it again?”

As we have said at the end of all of our work commitments, there are too many places to see and experience to return to the same place over and over. But we certainly would consider doing the job again at another location. We actually plan to do a little remote work for the same Jackson Hewitt franchise this coming tax season. While we did love Albuquerque, being somewhere cold in the winter isn’t our ideal situation. If the owner, Matt would purchase the Jackson Hewitt franchise in, say, the Florida Keys, we’d likely be back year after year! As we have in all our jobs, we enjoyed learning new things, meeting new people and exploring places nearby which is what we always hope our nomadic career is all about. For anyone interested in this particular workamping job in the future, please send us a message. We would be happy to provide you with more specific details about our experience and try to answer any questions you may have.

Disclosure: This post may contain affiliate links, meaning, at no additional cost to you, we will earn a commission if you click through and make a purchase. We only include links to products, services, and companies we have used and have had positive experiences with. Thanks for following our journey!

If you are curious about the world of Workamping, checkout Workamper® News the company that coined the term Workamper® back in 1987. They offer a free membership that allows you to search for jobs and receive the digital version of their magazine. If you do opt for the gold membership which includes additional features like a resume builder & printed magazine, we would love if you would mention that you were referred by Russ & Betsy simply by using the code AMB103.

RUSS & BETSY'S WORKAMPING REVIEWS / UPDATES:

- - - Jackson Hewitt in Albuquerque, NM (December 2018 - April 2019):

JACKSON HEWITT FINAL UPDATE

- - - Texas Lakeside RV Resort in Port Lavaca, Texas (November 2017 - November 2018):

- - - Acadia Bike & Coastal Kayaking in Bar Harbor, Maine (June - October 2017):

- - - Amazon Camperforce in Campbellsville, Kentucky (October - December 2016):